May 2025 brought a noticeable shift in the UK’s independent retail sector. After April’s spring uplift, sales volume dropped sharply across multiple categories. This report draws on Office for National Statistics (ONS) figures for May 2025 and 2024, complemented by industry analysis, to explain how weather, inflation, and consumer sentiment shaped performance in each sector.

Independent Clothing Stores: Weather and Inflation Combine to Squeeze Sales

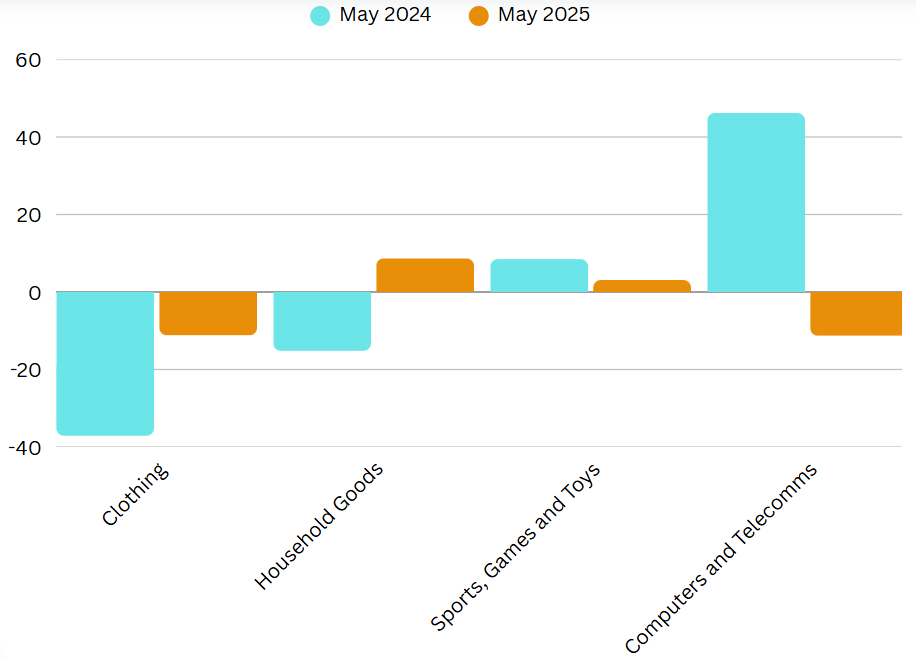

Independent clothing stores faced an 11.2% drop in May 2025, reversing April’s 3.5% gain, and following a dramatic 37.1% fall in May 2024. According to the Office for National Statistics, non‑food retail volumes declined by 1.4% in May, with clothing among the worst performing categories.

One key reason for the decline is seasonal timing: April’s unseasonably warm and sunny weather accelerated purchases of spring and summer apparel. According to PwC, this pulled demand forward, effectively exhausting consumers’ seasonal clothing budgets before May arrived. In contrast, May brought cooler and wetter conditions, especially during key retail periods like the bank holiday and school half‑term, reducing in store footfall and impulse spending.

Additionally, high inflation and lingering cost of living pressures have curbed consumer confidence. As noted by PwC, shoppers are more likely to delay or cancel discretionary purchases like fashion when household budgets are strained.

Independent Household Goods Stores: Pullback After Home Improvement Surge

Sales in the household goods sector increased by 8.7% in May 2025 a positive figure, but slower than April’s 12.9% surge. Compared to the 15.2% decline in May 2024, this represents a meaningful rebound and suggests improved resilience in the category. The ONS confirmed household goods as one of the few non food categories to post year on year growth in May.

The April May pattern reflects a seasonal cycle in home improvement behaviour. According to ONS analysts, April’s unusually warm weather encouraged many households to bring forward renovation and decorating projects, front loading purchases of paint, tools, and furniture. By May, this initial burst of activity had cooled, as projects completed early reduced the need for follow up purchases.

That said, growth remained positive due to improving employment rates and moderate inflation in the household goods space. According to Retail Week, these factors gave consumers some breathing room to invest in home aesthetics and minor upgrades, even amid broader economic caution.

Sports Equipment, Games & Toys: Decelerated Bounce

This category posted 3.1% growth in May 2025, following a robust 11.0% rise in April, and outpacing the 8.5% increase seen in May 2024. ONS data indicates demand for leisure and entertainment products remains robust despite broader non food sector weakness.

The April uplift was partly driven by favourable weather and holiday promotions, which boosted outdoor sports and family activity spending. However, May’s weather slowdown and fewer promotions cooled the pace slightly. Even so, spending on this category remained relatively strong.

According to PwC, consumers continue to prioritise “experience driven spending” , a trend that favours goods linked to wellness, hobbies, and family time. This reflects a post pandemic behavioural shift in which people place more value on home entertainment and physical activity than on fast fashion or tech gadgets.

Computers & Telecom Equipment: Abrupt Retrenchment

Sales in this segment plunged by 11.3% in May 2025, down from a 7.6% rise in April, and sharply lower than the 46.2% spike in May 2024. According to the ONS, this was the steepest monthly drop in the category since late 2023.

The sharp contrast is largely due to base effects. In May 2024, consumers were still making post pandemic upgrades to home tech, and several major device launches fueled purchasing. By May 2025, that demand had cooled. According to Reuters, the absence of new high profile product releases and a broader shift toward budget consciousness led to a slowdown in big ticket technology spending.

Persistent concerns over essential cost inflation, especially on groceries and housing, have also made consumers less willing to invest in non essential devices, particularly when existing products remain functional.

Broader Retail Context and Consumer Confidence

Total UK retail volumes declined by 2.7% in May 2025, the biggest monthly drop since December 2023, and were 1.3% lower year on year, according to the ONS. Analysts at Retail Week and Reuters attributed this contraction to the combination of April’s weather driven surge unwinding, poor May weather, and continued inflationary pressure particularly on food.

However, there are some signs of stabilisation. According to GfK, consumer sentiment improved modestly, with their confidence index rising three points to –20 in May. This was largely driven by reduced pessimism about personal finances and an uptick in job security perceptions.

That said, the improvement remains fragile. As reported by NielsenIQ, 70% of UK households still expect to cut back on discretionary spending, especially in categories like fashion, electronics, and premium goods. This restraint continues to anchor retail growth below pre pandemic levels.

Strategic Takeaways

- Clothing retailers should avoid over reliance on early spring surges driven by weather. Diversifying into summer styles earlier and expanding online loyalty programmes may help spread sales more evenly.

- Household goods retailers can capitalise on mid-year interest in home refreshment by aligning stock cycles with DIY trends and leveraging promotional tie-ins with seasonal décor.

- Sports and toy retailers are well positioned to benefit from ongoing consumer preference for recreation and wellness. Curated promotions around school holidays and social trends may sustain momentum.

- Tech retailers may need to explore alternative revenue streams such as accessories, tech services, refurbished devices, or subscription models, especially during product release lulls.

Conclusion

May 2025 served as a corrective month for UK independent retail following April’s exceptional surge. While clothing and tech segments saw sharp reversals, home and leisure categories demonstrated relative resilience. Despite some recovery in consumer sentiment, inflation and cautious spending continue to dominate the retail environment. Retailers that remain agile through product timing, omnichannel presence, and evolving value propositions will be best placed to navigate this period of volatility.

Leave a Reply