Introduction

The UK retail sector in April 2025 presented a blend of steady recovery and ongoing structural challenges across various segments. According to the Office for National Statistics (ONS), independent retailers showed positive momentum in several categories compared to April 2024, reflecting a rebound in consumer confidence, seasonal factors, and evolving market trends. This report examines the performance of key retail sectors, exploring potential reasons behind the changes and what they reveal about the wider retail landscape.

Independent Clothing Stores: Recovery Slows but Remains Positive

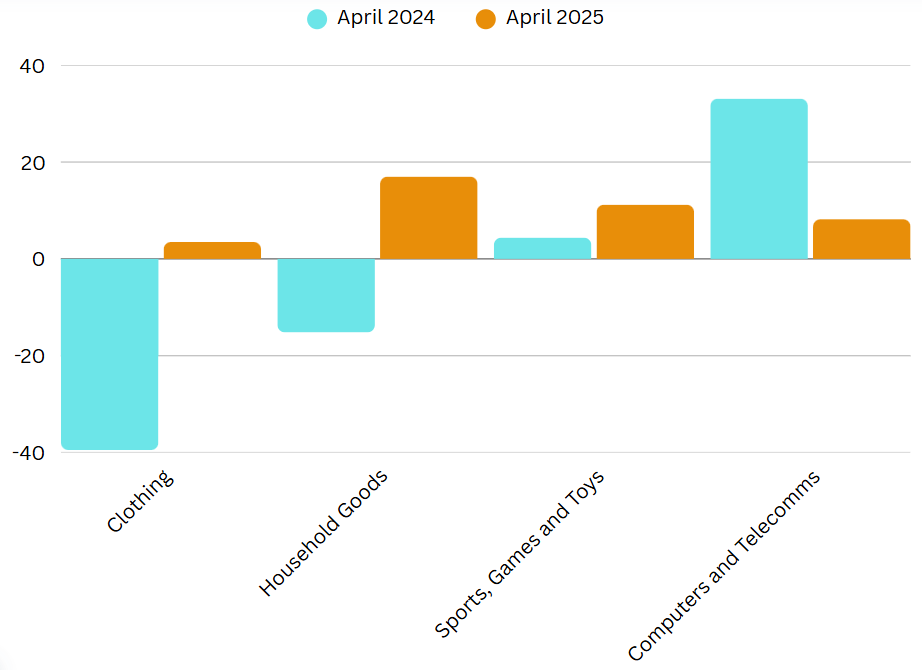

Independent clothing stores reported a 3.5% increase in sales in April 2025, building on the stronger 15.4% growth seen in March. This marks a sharp contrast to April 2024, when sales fell by 39.5%. According to The Guardian, the significant drop in 2024 was largely due to the ongoing cost of living crisis, which led many consumers to reduce discretionary spending on non-essential items like clothing. Inflationary pressures and energy costs continued to squeeze household budgets throughout 2024, contributing to widespread store closures in the sector.

By April 2025, stabilising inflation and improving wage growth, as noted by the Bank of England in its March 2025 Monetary Policy Report, provided some breathing room for consumers. Additionally, the Met Office reported a warmer-than-average April, which likely encouraged shoppers to refresh their wardrobes for spring. However, while the monthly increase is positive, the slower growth compared to March suggests that recovery in the clothing sector remains fragile, with lingering competition from fast fashion giants and online marketplaces.

Independent Household Goods Stores: A Strong Surge

Independent household goods stores saw a 17% increase in sales in April 2025, following a 13.6% gain in March. This represents a significant turnaround from April 2024, when sales dropped by 15.2%. According to Reuters, the surge in household goods sales is partly driven by consumers investing in home improvement projects, motivated by stabilising mortgage rates and a focus on enhancing living spaces.

Furthermore, the easing of energy bills, as reported by the BBC, has freed up some household budgets, allowing more discretionary spending on home-related products. Promotional offers and extended financing options introduced by many independent retailers in this sector have also helped attract cost-conscious shoppers looking for value and quality.

Sports Equipment, Games, and Toys: Continued Growth in an Active Market

The sports equipment, games, and toys sector recorded an 11.2% increase in April 2025, following a 15.1% rise in March. This compares favourably to April 2024, which saw a modest 4.4% gain. According to Mintel’s 2024 UK Health and Fitness Market Report, consumers continue to prioritise health, wellness, and outdoor activities, driving demand for sports equipment and active lifestyle products.

The timing of school holidays in April, alongside favourable weather, likely contributed to stronger sales in outdoor games and family-oriented recreational products. Additionally, the enduring popularity of home-based gaming, fuelled by new console releases and subscription services, has helped sustain growth in this sector.

Computers and Telecom Equipment: Growth Slows as Market Matures

Sales in the computers and telecom equipment sector rose by 8.2% in April 2025, following a 16.5% increase in March. However, this growth is more subdued compared to the 33.1% surge recorded in April 2024. According to the Financial Times, the exceptional growth in 2024 was driven by pent up demand following pandemic related digital transformation and remote working trends.

By 2025, much of that demand has been met, leading to a natural cooling-off period. Market saturation, fewer major product launches, and cautious business investments have also tempered growth. However, as noted by Ofcom in its 2025 Telecoms Update, there remains a steady underlying demand for 5G connectivity and small business digital infrastructure upgrades, supporting moderate growth in the sector.

Conclusion

April 2025 reflects a retail sector in cautious recovery, with positive trends across independent clothing, household goods, and recreational categories. While growth has moderated compared to the stronger gains of March, year on year comparisons show a marked improvement from the difficult trading conditions of 2024. Independent retailers who continue to innovate, focus on value, and adapt to shifting consumer behaviours are well-placed to navigate the evolving market landscape. The outlook for the coming months will depend on the broader economic environment, consumer confidence, and the ability of businesses to remain agile and customer focused.

Leave a Reply